Insurance Management – Dash SaaS Add-On.Digitize and streamline insurance operations with the Insurance Management – Dash SaaS Add-On. Built for insurance agencies, brokers, and financial institutions, this powerful tool helps manage policies, claims, renewals, client information, premium payments, and compliance tracking—all from a unified dashboard. Seamlessly integrated with Dash SaaS, this insurance management system enhances productivity, improves customer service, and ensures accuracy in policy handling.

Note: This is an addon for WorkDo Dash SaaS, not a standalone script.

WorkDo Dash SaaS - Open Source ERP with Multi-Workspace

Streamline your insurance operations effortlessly with our powerful and feature-rich Insurance Management Add-On. Whether it's managing clients, handling policies, processing claims, or generating invoices, every essential task is accessible from one unified dashboard. This centralized approach improves efficiency, reduces manual errors, and ensures regulatory compliance. Designed for scalability and accuracy, it supports seamless workflows for both agents and administrators. With built-in tracking and analytics, you stay informed and in control at all times.

Check here : Integrate Insurance Management with ERP System | Streamline Tasks

Insurance Automation, Optimize Risk, and Streamline Policy Operations

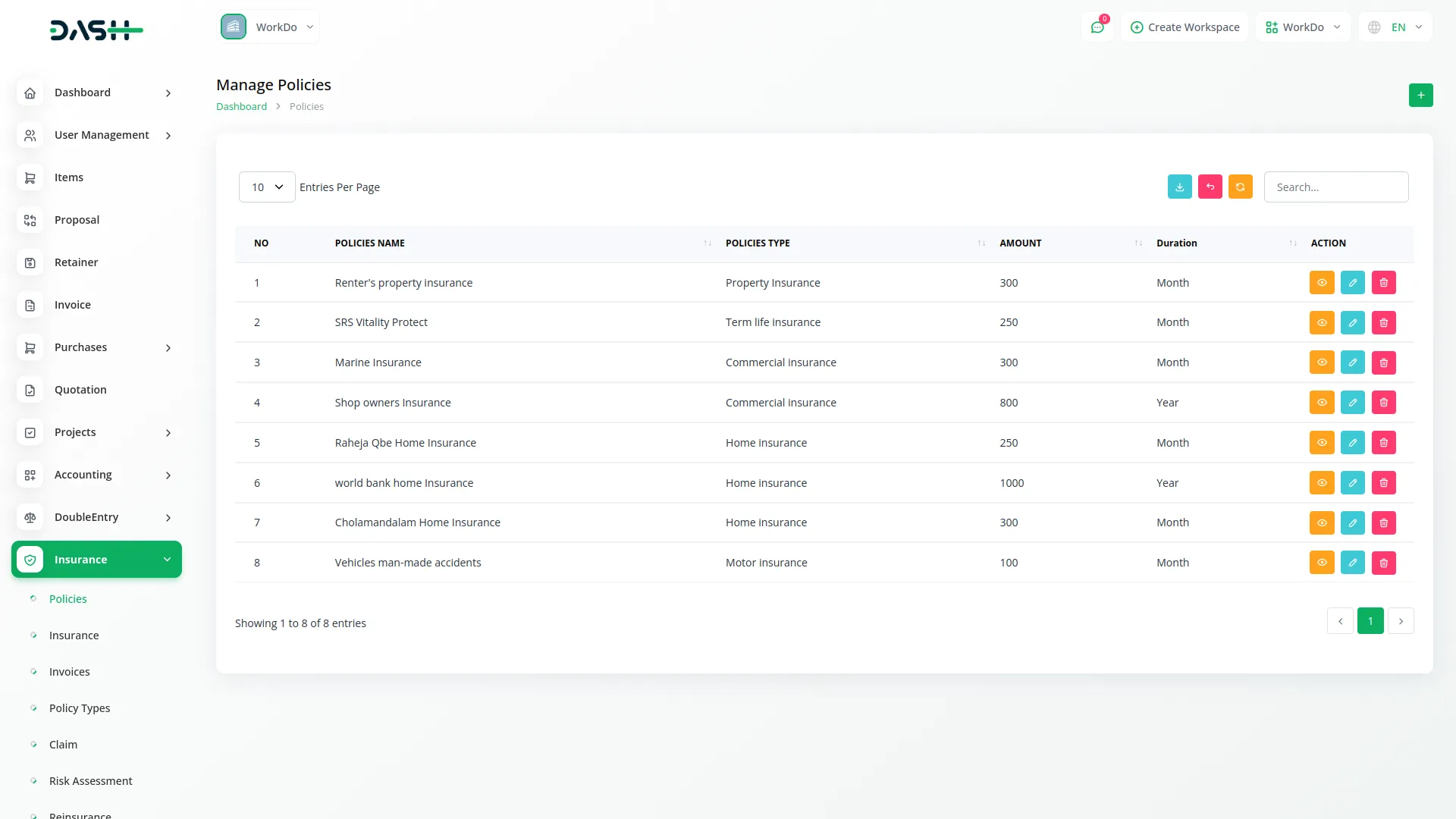

Policy Lifecycle Management

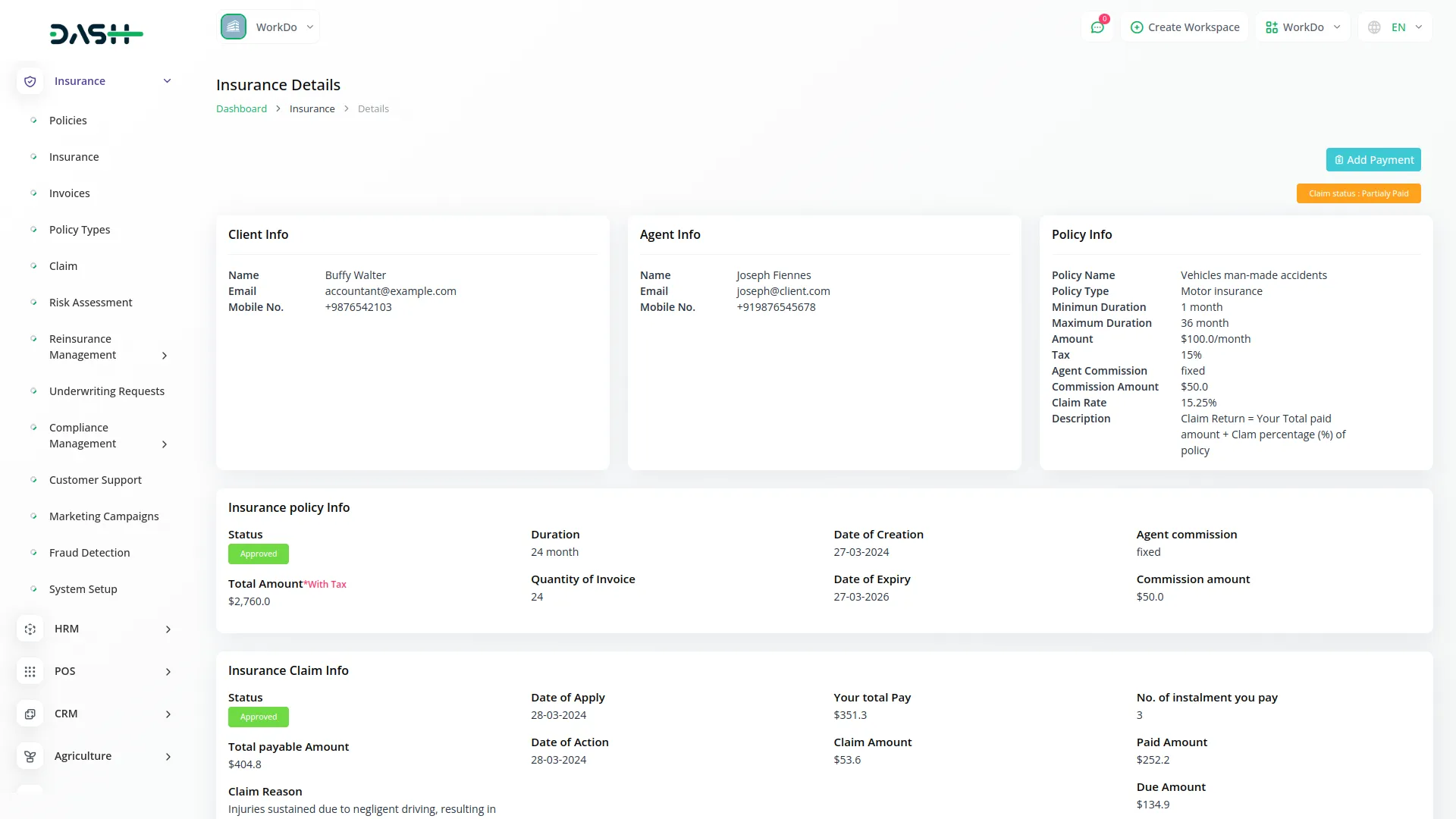

Create and manage various policy types with custom codes. Build policy records by selecting policy type, duration format, commission structure, policy amount, and taxation. Include minimum/maximum terms, tax percentages, claim limits, and detailed descriptions. Users can assign policies to agents and clients with start dates and durations. Each insurance record can be accepted or rejected and includes full detailed views with invoice conversion features. This Add-On supports a full cycle from policy design to client-specific issuance.

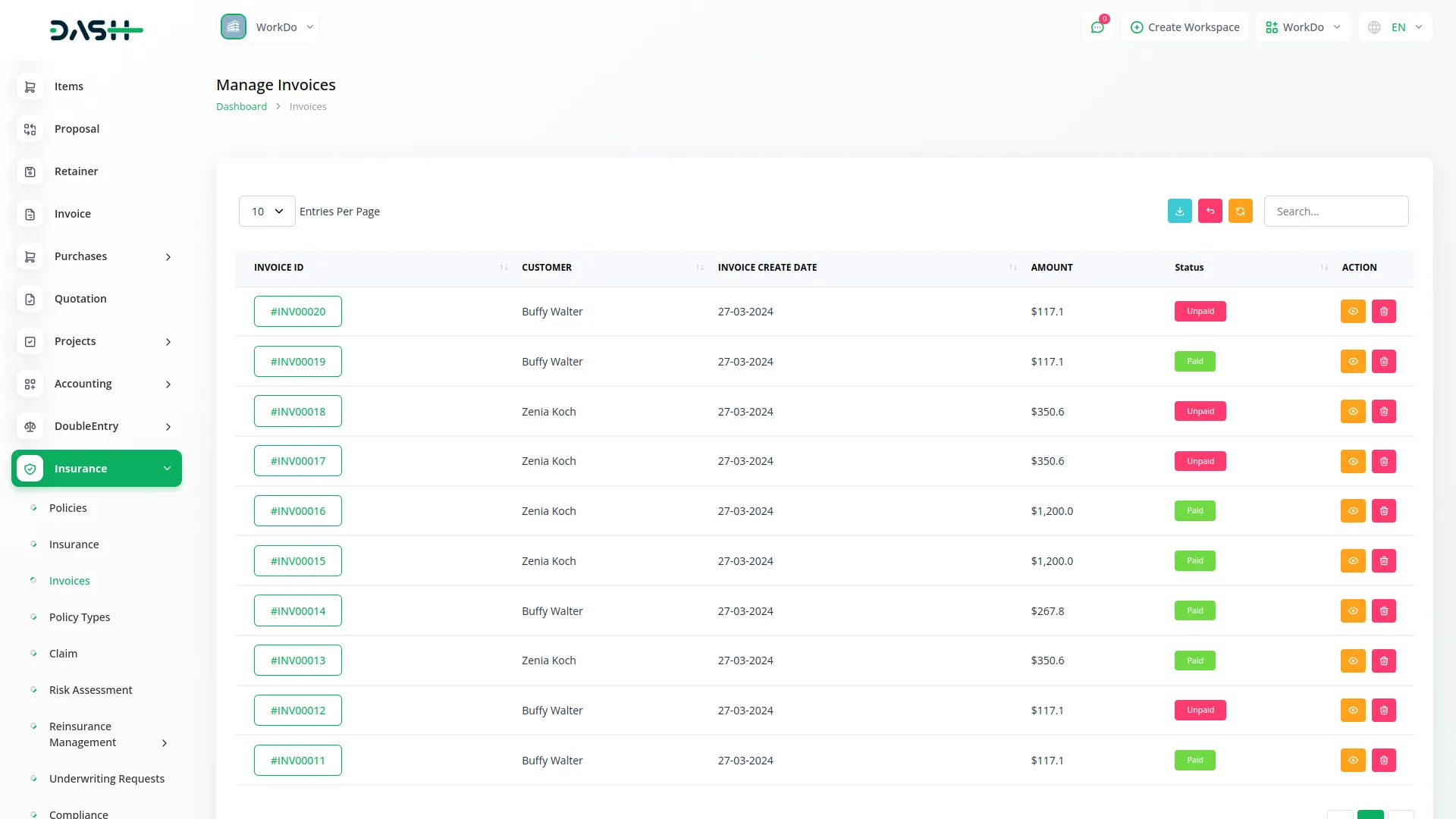

Invoice & Payment Tracking

Easily track installment-based invoices generated from insurance policies. Only invoices converted from installment data are displayed, showing amounts, creation dates, and payment status. Actions include editing and deletion, with quick views to assess payment timelines. This helps finance teams keep track of dues and ensures clear billing records for clients. All invoice statuses are used in dashboard visualizations for holistic tracking.

Claims Management Process

Access a dedicated space for managing client claims against active insurance. Displayed claims include status, client and policy info, action dates, and payment status. Each claim connects to an insurance record, allowing you to open detailed views that cover agent, client, and policy information, including invoices and related installments. Admins can accept or reject claims with traceable action histories, ensuring a complete audit trail.

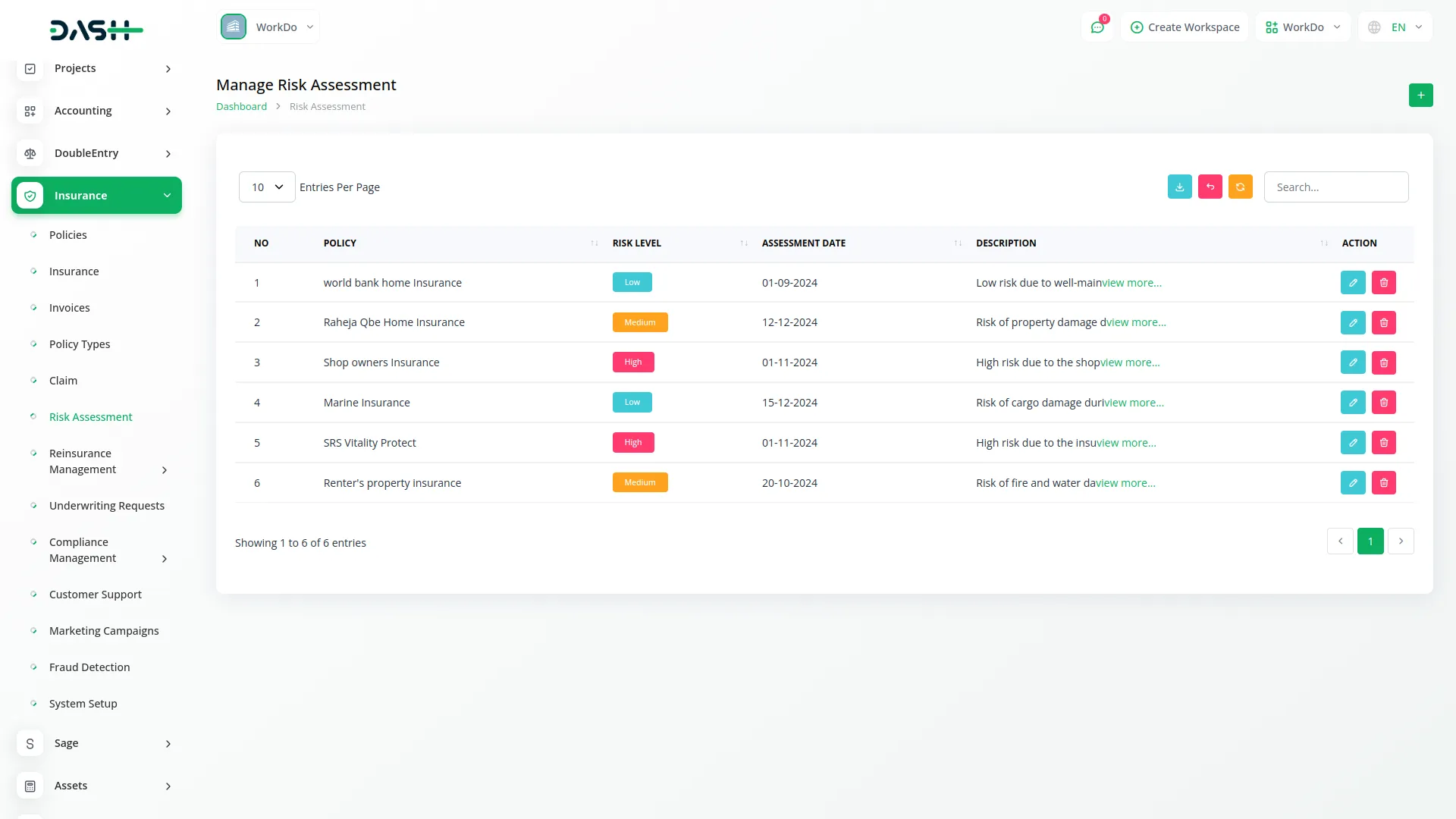

Risk & Reinsurance Controls

Assess policy risks with detailed entries including assessment date, level, and descriptions. Link risk reports to specific policies and store historical records. Add reinsurance agreements with reinsurer details, coverage and premium share percentages, agreement dates, and statuses. Claims under reinsured policies can be logged and managed, including reimbursements, statuses, and claim dates. This menu safeguards financial exposure and simplifies co-insurance tracking.

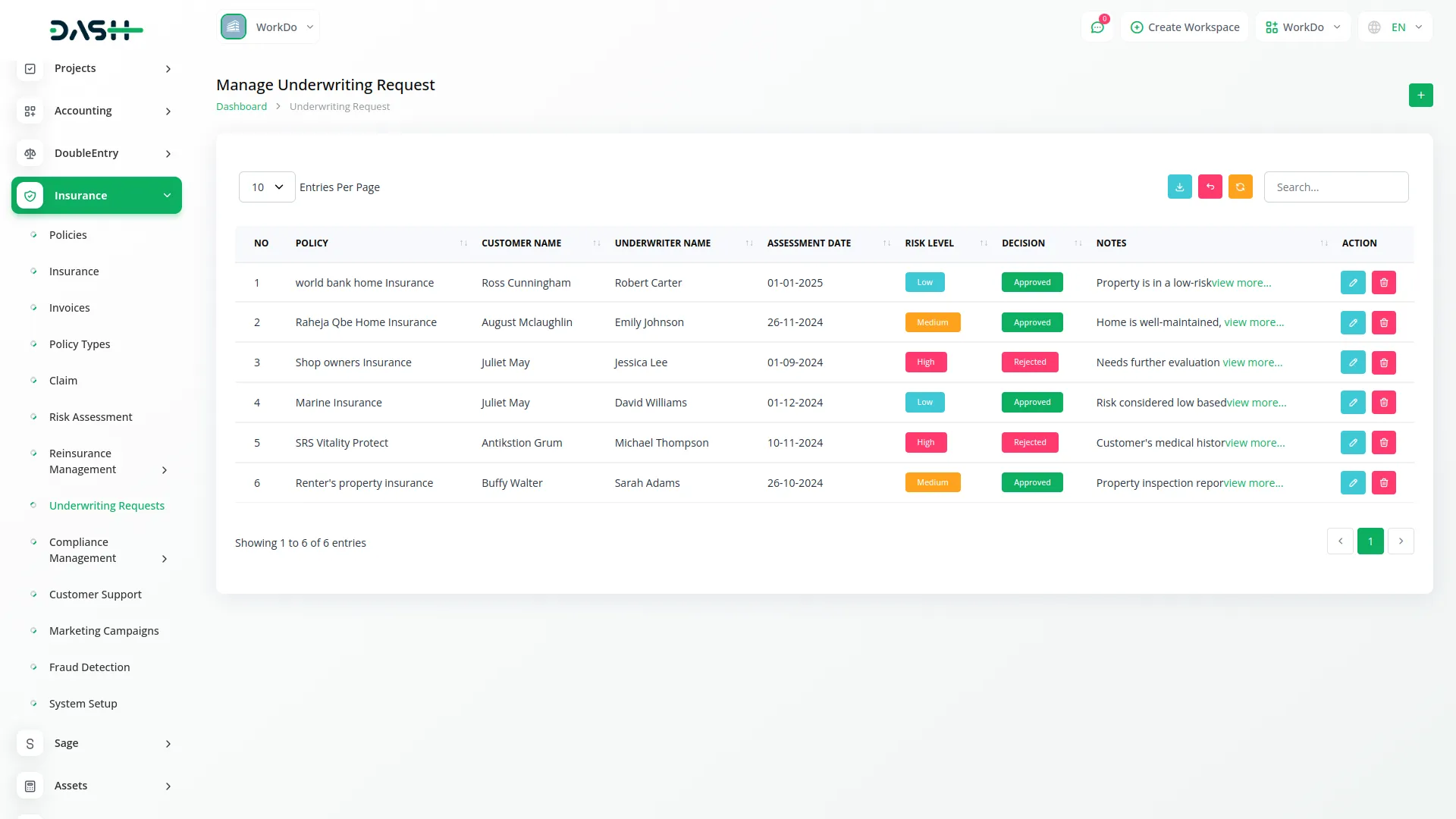

Underwriting & Compliance Records

Submit and manage underwriting requests by connecting customers to underwriters. Each request logs policy, client, risk level, decision outcome, and notes. Compliance records store assessments related to policies, such as completed or pending document evaluations, supported by document uploads. The menu ensures every policy meets legal requirements and underwriting standards. It also enables data-driven risk control across the policy lifecycle.

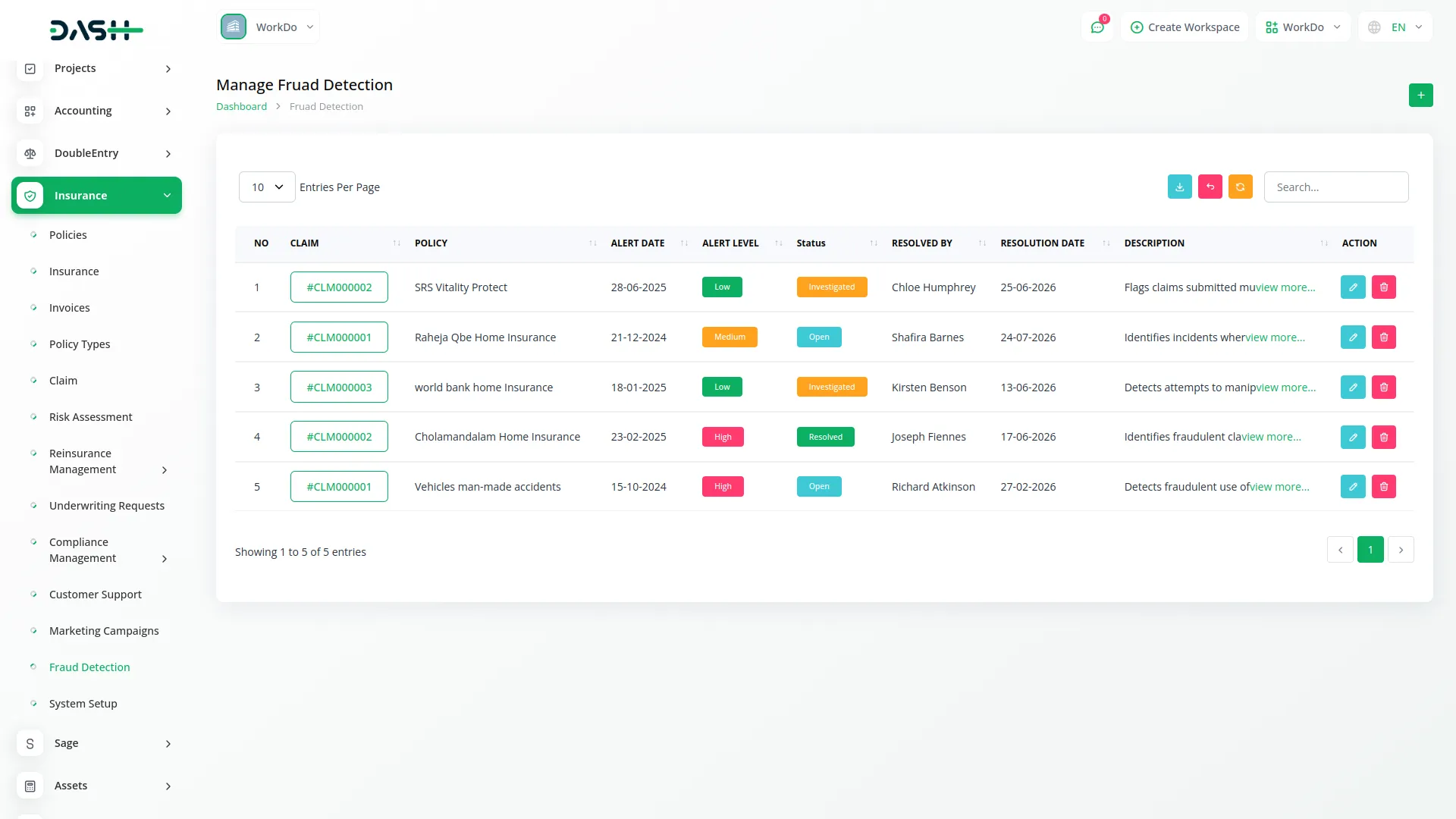

Campaigns & Fraud Detection

Launch and monitor marketing campaigns with start/end dates, audience targets, budgets, and statuses. Easily adjust active or completed campaigns to boost client engagement. Meanwhile, fraud detection entries flag suspicious claims by alert date, level, and resolution details. Admins can log actions, assign investigators, and track resolution progress — helping reduce fraudulent activities and improve trust in policy issuance and claims handling.

Check here : View WorkDo Dash SaaS Documentations

Check here : Explore WorkDo Dash SaaS User Manual

Check here : How to install Dash Add-On

Last update:

Mar 10, 2026 09:06 AM

Version:

v1.0

Category:

High Resolution:

YesSoftware Version:

Files Included:

Software FrameWork:

LaravelPublished:

Jul 23, 2025 11:10 PM