The Service Tax Add-On for BookingGo SaaS allows businesses to effortlessly manage, calculate, and apply applicable service taxes on all bookings. Ensure compliance with local tax regulations while providing transparent pricing to your customers. This add-on automatically adds the correct tax to each booking, saving time and reducing errors in billing.

Note: This is an addon for WorkDo BookingGo SaaS - Multi Business Appointment Booking and Scheduling, not a standalone script.

BookingGo SaaS - Multi Business Appointment Booking and Scheduling

Efficiently manage your service tax requirements with the BookingGo SaaS Service Tax Module. Designed to simplify tax compliance for service-based businesses, our module offers comprehensive features to streamline tax calculations, reporting, and filing processes.

Check here : Service Tax Module Integration | Streamlining Tax Management with Bookinggo SaaS

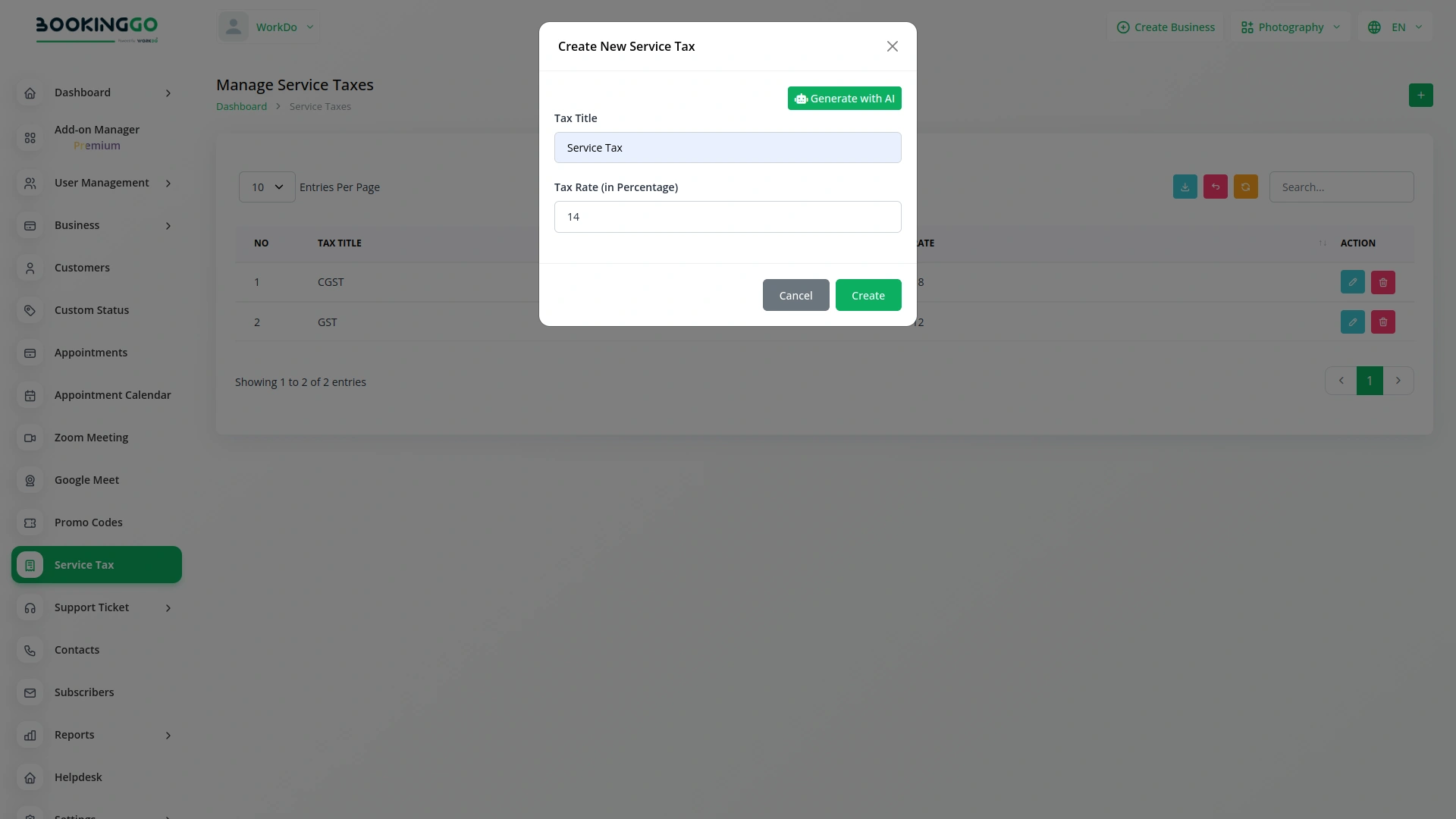

Automated Tax Calculation

Say goodbye to manual tax calculations. Our module automatically calculates service taxes based on predefined rules and rates, ensuring accuracy and consistency in your tax calculations. Whether it's GST, VAT, or other service taxes, our system handles it all easily, saving you time and reducing the risk of errors.

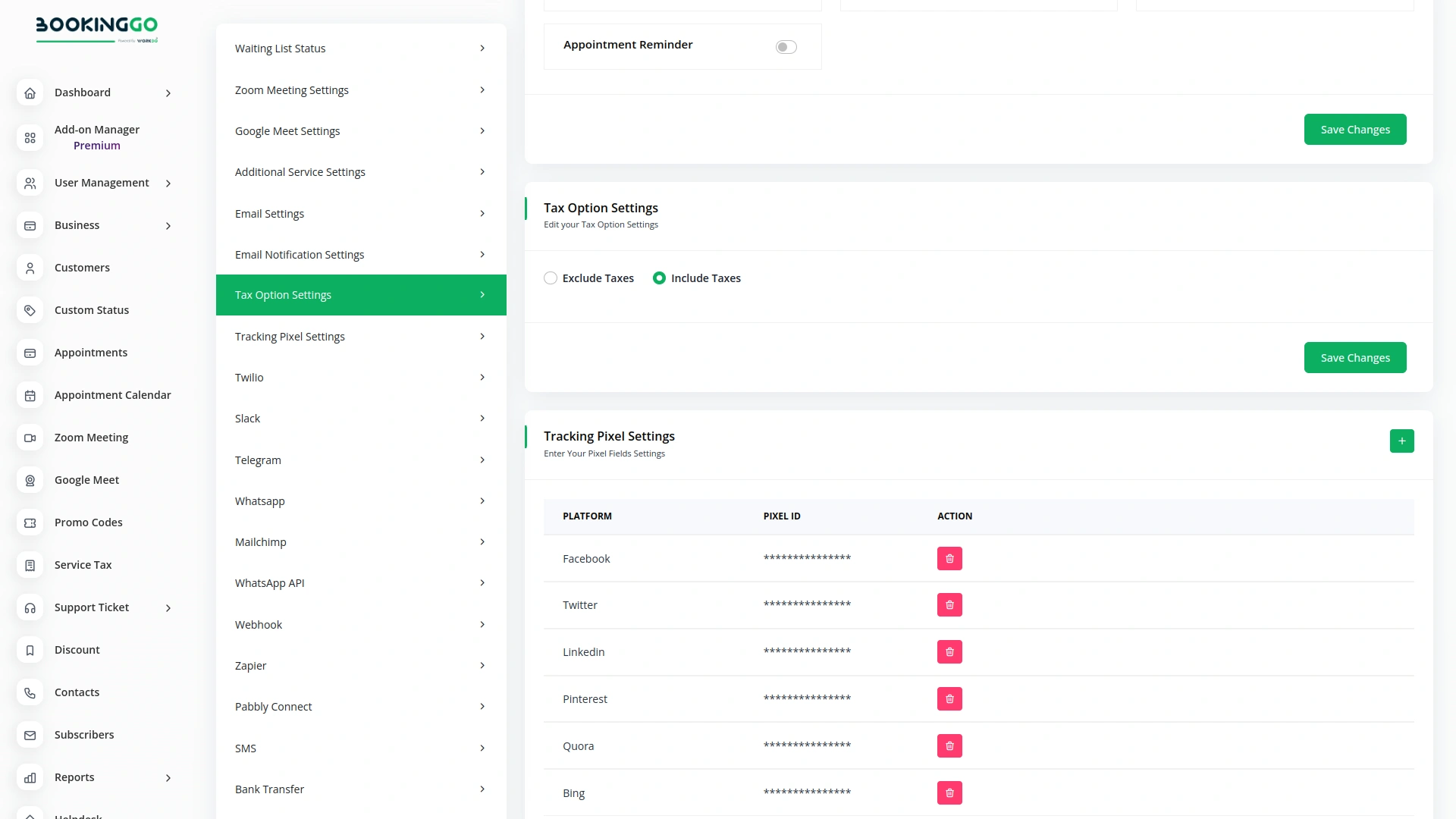

Customizable Tax Rules

Tailor tax rules to suit your business needs. Whether you operate in multiple regions or have unique tax requirements, our module allows you to customize tax rates, exemptions, and thresholds effortlessly. With flexible tax rule configurations, you can ensure compliance with local tax laws and regulations while catering to the specific needs of your business.

Check here : Documentation

Last update:

Mar 10, 2026 08:55 AM

Version:

v1.0

Category:

High Resolution:

YesSoftware Version:

Files Included:

Software FrameWork:

LaravelTags:

Published:

Sep 04, 2025 10:03 PM